Improve performance and profit by benchmarking your liquor store

You can’t tell if your liquor store’s operating and financial results are optimal if you don’t benchmark against others in your industry. Benchmarking against best practice lays the groundwork for continuous business improvement and fine-tuning performance indicators.

Benchmarking

- improves existing processes and procedures

- review outcomes of past financial performance and introduces change and action

- allows you to review your liquor store against others

- aims to increase efficiency and lower costs, making your store more profitable

- improves quality and customer experience.

Before you can benchmark effectively, you need a meaningful set of financial reports relevant key financial performance indicators. Getting your financial results from your accountant at the end of the year isn’t good enough if you want to maximise profits and performance. You need information daily or weekly.

A good benchmarking process measures you against the leaders within your industry as well as liquor stores that are similar in size and location over time.

What are some useful liquor store benchmarks?

Ratio or measure | Liquor industry benchmark |

COGS % The cost of goods sold as percentage of total revenue or gross sales | 69% to 81% depending on size and location of store |

Gross Profit Margin Ratio The proportion of profit for every sales dollar before expenses. The higher ratio, the better. | 15% to 31% |

Net Profit Margin Ratio The proportion of profit for every sales dollar after expenses. The higher the ratio, the better. | 6% to 15% of Sales Turnover |

Wages % The proportion of costs that are wages | 6-11% depending upon turnover and location |

Return on Investment (ROI) ROI = Net Profit/Owner’s Equity How efficient a business is at generating profit from the original investment (equity) from owners or shareholders. | 15-33% depending upon location, turnover and competition |

Stock Turnover Rate The number of times stock is replaced each year | 7.5 to 11 times |

Current Ratio Current Ratio = Current Assets/Current Liabilities Ranges A business’ liquidity, or how quickly it can convert assets into cash to pay bills or liabilities. A higher current ratio indicates a stronger financial position but it is recommended not to keep too high. | 1.58 to 4 depending upon stock levels and level of funding |

Quick (Acid Test) Ratio Current Assets – Inventory)/Current Liabilities. A more conservative measure of liquidity that excludes inventory. | 0.5% to 2% |

Choosing the right reporting software and systems for liquor store reporting and benchmarking

There are many online software and accounting products available to assist managing liquor store performance reporting. But some dedicated reporting and benchmarking programs can be expensive and not deliver value for money. A standard reporting package might not suit your unique business needs.

Being clear on the type of financial reporting you are after will help you to find the right program(s) for your circumstances.

You may be able to create reports from existing systems by simply having your existing point of sale and member loyalty systems talk to your accounting system such as Fathom, Xero or MYOB. Whatever system you use, it must be able to talk to your accounting system.

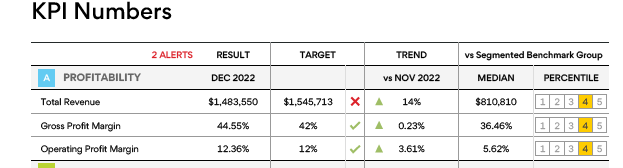

Here is a basic example from Fathom.

Example of the financial impact of making improvements from benchmark reporting

The following table demonstrates the impact you can have on your liquor store profitability by focussing on improving just some of your financial indicators. In this example, focusing on improving gross profit, wages and earnings before interest tax depreciation and amortisation (EBITDA) increases net profit by 7% or $154,000 without increasing revenue. This is obviously an illustrative and perhaps optimistic example. Improvements will depend on a range of factors including your demographic and product mix, but it illustrates the value of a good reporting framework.

Liquor Store Financial Indicator | Current | What if | ||

Liquor Sales | 2,200,000 | 100% | 2,200,000 | 100% |

Gross Profit | 484,000 | 22% | 616,000 | 28% |

Wages | 220,000 | 10% | 198,000 | 9% |

Other Direct Costs | 66,000 | 3% | 66,000 | 3% |

Overheads | 145,000 | 7% | 145,000 | 7% |

Net Contribution | 53,000 | 2% | 207,000 | 16% |

EBITDA | 53,000 | 2% | 207,000 | 9% |

Potential improvement in profit |

|

| 154,000 | 7% |

Cost effective expert help with liquor store reporting and benchmarking

It can be cost and time effective to use an accountant or business advisor with expertise in business management or reporting to help you to set up your framework.

A liquor industry business advisor or accountant can also help you to effectively benchmark against others in your industry. They will understand which benchmarks are relevant to your business. Comparing your liquor store’s performance against other stores needs to consider many factors such as:

- location

- age and demographic of customer base

- product mix of sales

- competition

- size of business

- variety of products available

- management skills.

Why use the Pitcher Partners’ Hospitality Team for liquor store reporting and benchmarking?

Pitcher Partners has more than 50 years’ experience in assisting businesses with accounting, benchmarking and reporting. It has specialists in the liquor and hospitality industry who understand that each business is unique and at different stages in its life-cycle, with different strategic goals and specific measures of success.

Our expert team of accountants and advisors have helped many liquor stores and other businesses, large and small, to set up an effective reporting framework and help with benchmarking, analysing results and identifying actions to improve performance.